My Funded Futures: A Comprehensive Overview

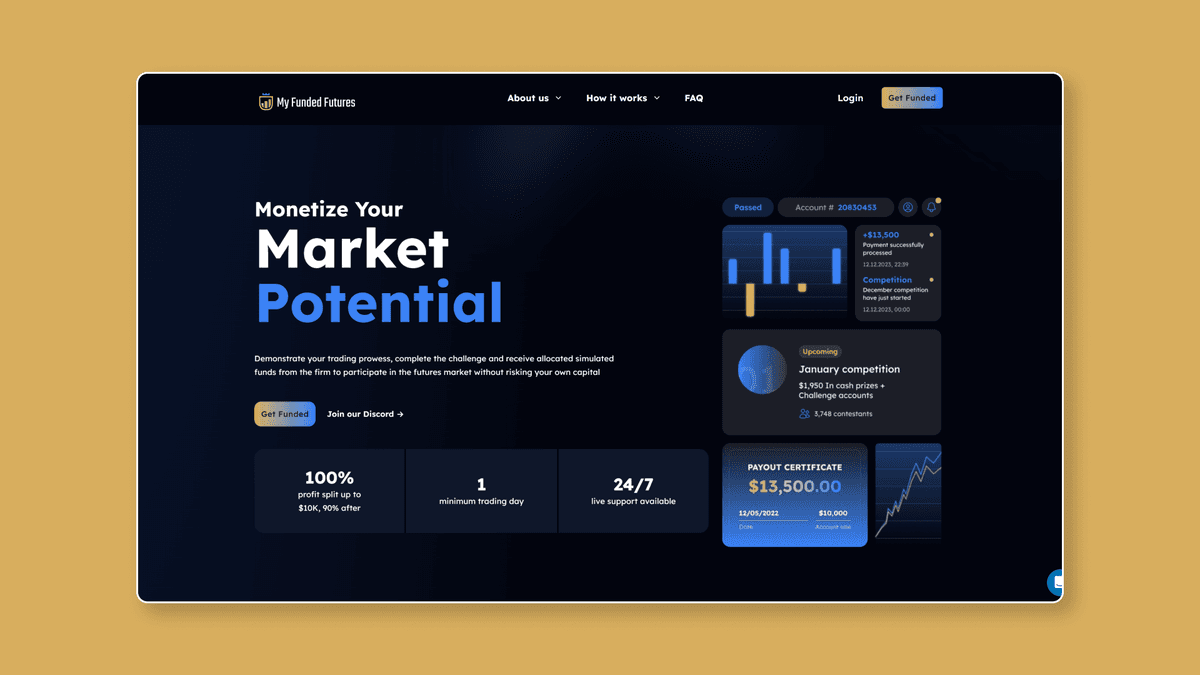

My Funded Futures (MFFU) is a proprietary trading firm that provides aspiring and experienced traders an opportunity to trade futures markets without risking their own capital. By completing a structured evaluation process, traders can secure a funded account with favorable profit splits and flexible rules. This article explores MFFU’s account types, rules, pros, and cons.

Account Types at My Funded Futures

MFFU offers several account types tailored to various trading styles and experience levels:

Starter Plan

The Starter Plan is designed for beginners or traders looking for a cost-effective entry point into funded trading.

- Account Size: $50,000

- Profit Target: $3,000

- Maximum Drawdown: $2,500

- Daily Loss Limit: $1,200

- Features:

- No minimum evaluation days.

- Weekly payout eligibility after five winning days.

- Trailing end-of-day (EOD) drawdown.

Starter Plus Plan

The Starter Plus Plan builds upon the Starter Plan with additional flexibility and higher account sizes.

- Account Sizes: $50,000, $100,000, $150,000

- Profit Targets: $3,000 to $9,000

- Maximum Drawdown: $2,000 to $4,500

- Features:

- No daily loss limits during evaluation.

- Eligible for payouts after five winning days.

- No activation fees.

Expert Plan

The Expert Plan is suited for experienced traders seeking higher contract limits and simplified rules.

- Account Sizes: $50,000 to $150,000

- Profit Targets: $4,000+

- Maximum Drawdown: $2,000 to $4,500

- Features:

- Higher contract limits.

- Simpler payout processes.

- Zero daily loss limits.

Milestone Plan

The Milestone Plan offers a phased approach to funding with early payout opportunities.

- Account Sizes: $50,000, $100,000, $150,000

- Profit Targets per Phase: $3,000 to $9,000

- Features:

- Four-phase evaluation process.

- Early payouts at each phase completion.

- 20% consistency rule to encourage steady trading.

Trading Rules at My Funded Futures

MFFU’s trading framework is designed to foster discipline and long-term profitability:

- Consistency Rule:

- Applies in the Sim Funded Stage.

- Profits from one day cannot exceed 40% of total profits.

- End-of-Day (EOD) Trailing Drawdown:

- Tracks daily account performance and adjusts based on gains.

- Locks after reaching a set threshold.

- Daily Loss Limits:

- Applicable in some plans (e.g., Starter) to curb excessive risk-taking.

- Prohibited Practices:

- Use of automated trading bots.

- Exploiting illiquid markets or simulated fill algorithms.

- Placing excessive orders at identical prices.

- Trading Hours:

- Allowed between 6:00 PM and 4:10 PM EST.

- Positions must be closed by the end of the trading session.

- Withdrawal Requirements:

- Sim-funded accounts require five winning days for initial withdrawals.

- Traders progress to live accounts after achieving specific payout milestones.

Payout Policies at My Funded Futures

MFFU provides a flexible and trader-friendly payout structure designed to reward consistent performance. Initially, traders are eligible for withdrawals after achieving five winning days in the Sim Funded stage. This ensures that traders demonstrate consistency before accessing their profits.

For funded accounts, the payout structure is particularly attractive. Traders keep 100% of their profits up to $10,000, allowing them to capitalize on their initial success fully. Beyond this threshold, a generous 90% profit split ensures that traders retain the majority of their earnings while contributing a small share to MFFU.

Payouts are processed regularly, with some plans offering weekly withdrawal options. This provides traders with liquidity and the ability to manage their finances effectively. However, traders must adhere to withdrawal rules, such as the 40% consistency requirement in the Sim Funded stage, to ensure that their trading performance remains steady over time.

The Milestone Plan offers an additional benefit of early payouts at each phase, further incentivizing traders to progress through the evaluation stages. These phased payouts provide immediate rewards for hitting key targets, fostering motivation and financial support throughout the trading journey.

Pros and Cons of My Funded Futures

Pros

One of the standout advantages of MFFU is its flexibility. With unlimited trading days during evaluation and no consistency requirements in the evaluation phase, traders can progress at their own pace. This approach allows individuals to focus on steady growth without feeling pressured by time constraints.

MFFU’s profit splits are another major benefit. Traders receive 100% of profits up to $10,000 and 90% thereafter, making it one of the most competitive offerings in the industry. This structure rewards traders generously for their efforts and success.

Additionally, MFFU’s accessible pricing makes it a viable option for traders of all experience levels. The low entry costs, combined with active community support and responsive customer service, create an environment conducive to growth and learning.

Finally, the early payout opportunities in the Milestone Plan encourage consistent performance. Traders can see tangible rewards early in the process, fostering motivation and confidence.

Cons

Despite its benefits, MFFU’s strict rule enforcement can pose challenges for some traders. Breaches, such as exceeding drawdown limits, result in account resets, which can be frustrating and costly. Traders must maintain discipline to avoid these setbacks.

The restriction on automated trading is another limitation. MFFU prohibits bots and full automation, which may deter traders from relying on such strategies. This rule ensures fairness but may limit flexibility for tech-savvy traders.

Withdrawal restrictions in the early stages can also be a drawback. Tying withdrawals to performance consistency might delay access to profits, which could be inconvenient for some.

Lastly, the cost of account resets, especially for higher-tier plans, is significant. While the initial fees are competitive, the reset expenses can add up, especially for traders still finding their footing.

Final Thoughts

My Funded Futures provides a robust platform for traders to demonstrate their skills and transition to funded trading. Its diverse account types, supportive community, and favorable payout structure make it a popular choice among futures traders. However, the strict adherence to rules and potential costs for resets require traders to maintain discipline and consistency. For those willing to put in the effort, MFFU is a gateway to a rewarding trading career.

![[object Object] Image](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fmz50gtnc%2Fproduction%2F9563e983f9926ef81abba7456e1b987a47e1bc76-1920x1080.png&w=1080&q=75)

![[object Object] Logo](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fmz50gtnc%2Fproduction%2F6031a8fe180b5b20056627c752cd64cff220bdad-225x225.png&w=128&q=75)

![[object Object] Image](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fmz50gtnc%2Fproduction%2Fa5797d8a544cb808524aee36fc7a33bb1e1f0975-1920x1080.png&w=1080&q=75)

![[object Object] Logo](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fmz50gtnc%2Fproduction%2F1124762e3dbbf35ba01d5be6028a3f9252abf81a-401x401.png&w=128&q=75)

![[object Object] Image](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fmz50gtnc%2Fproduction%2Fd52bade145cf214604cf5ba737881e3f2108a423-1920x1080.png&w=1080&q=75)

![[object Object] Logo](/_next/image?url=https%3A%2F%2Fcdn.sanity.io%2Fimages%2Fmz50gtnc%2Fproduction%2F43ce01a8cbe299f4c15cfd07f43bb133414567ed-265x265.png&w=128&q=75)